Hinojosa says many people don’t realize their credit score is one of the biggest indicators when it comes to the mortgage qualification process, and could impact the interest rate you receive for your mortgage.

“That’s one of the very first things a bank or a mortgage broker would consider or would look at,” she explains. “It’s equally as important as your income or affordability of paying a mortgage.”

Hinojosa says many mortgage products are credit score-driven, meaning your credit score will determine what interest rates may be made available to you, as well as your ability to qualify for certain mortgage products and types.

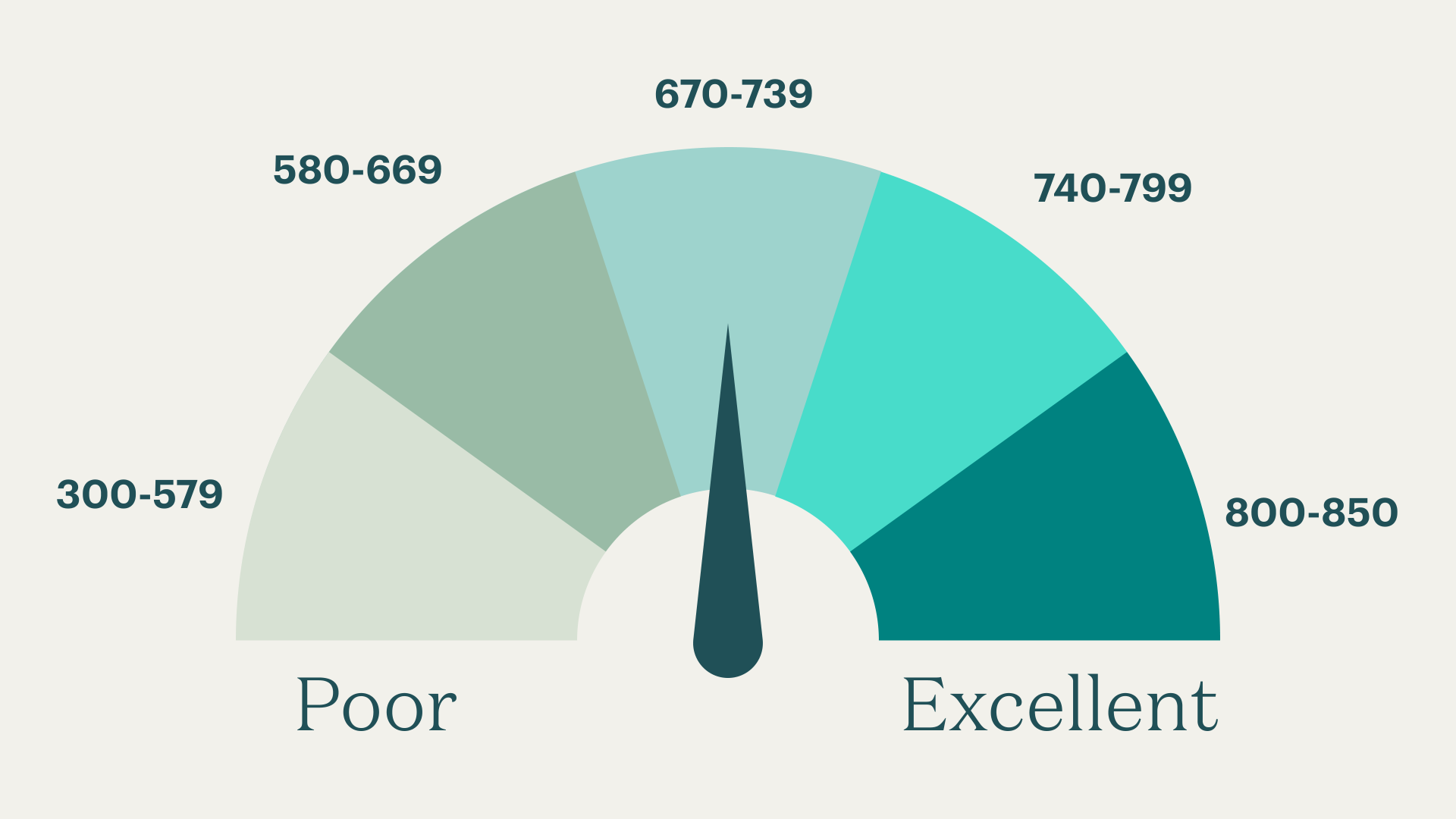

A score of 680 and above is the sweet spot that’ll give you access to most products—anything less than this might limit your options. If you have a score of 600 or less, you may be looking at higher risk-based pricing on your mortgage and interest rate offerings.

Your credit score is determined by a number of factors, such as your credit payment history, the amount of credit you have available, and how long you’ve had it for. Having a healthy credit score demonstrates to a lender you can meet your payment commitments over time.

“It shows the consumer is responsible and has a track record of owning up to their obligations and paying as agreed,” said Hinojosa. “That also plays into risk-based pricing on the actual mortgages, as well.”

There are a handful of indicators that play a role in shaping your credit score, according to Hinojosa.

One of the most influential factors is your payment history, which includes making sure you pay your debts on time. Thirty-five per cent of your credit score is based on payment history. If you can’t pay off your credit card in full, Hinojosa recommends making at least the minimum payment by the due date to keep your score in good shape. Having a public record of being in collections or bankruptcy may also impact your credit score.

Another factor is how you use your credit. You’ll want to avoid charging up to the maximum amount or upper limits of your credit card. Hinojosa suggests keeping your credit charges to around 30% of your limit each month. Thirdly, your credit score is influenced by how much credit you have available. Occasionally, Hinojosa sees consumers that don’t have any credit, or those that believe using credit is a bad thing. However, having a history of varied credit use, such as a couple of credit cards and a car loan, proves you have a history of making payments.

How long you’ve had access to credit is also important, as the more time you’ve had credit history, the better. Hinojosa compared this to car insurance.

“Usually when you’re a new driver, it’s a bit more expensive. Whereas if you have a good driving history, the longer the good driving history, the lower your insurance premium,” she explained. “It’s very much the same when it comes to credit. The longer you show a history of repeating good credit, the better it will be for your credit score.”

Finally, making an inquiry on your credit accounts for 10% of your overall score. Some consumers tend to get concerned when they’re shopping for a mortgage that they’re going to take a hit on their credit score, but Hinojosa says consumers shouldn’t be overly concerned if a lender is making an inquiry as part of the mortgage process. On the other hand, Hinojosa says you may not want to apply for many types of credit all at once, as this will result in multiple back-to-back inquiries.

“If you already have excellent credit, let’s say 720, [at] 10% of that, it’s only going to impact your score by seven points,” she said. “It’s not going to put you from an excellent category to a bad category. It’s probably the least of the indicators to worry about in the overall impact of your credit score.”

If you’re planning to buy a home in the future, but aren’t sure how your credit score stacks up, Hinojosa says making inquiries in advance with a mortgage professional can be helpful to find solutions for tweaking your credit score. In some cases, home buyers may need to address items in collections, pay down their credit limits, or make other changes to bump up their score.

“I don’t think too early is ever too soon,” said Hinojosa. “If you’re thinking about financing a home, don’t be afraid to have a conversation and start the process because there are always solutions to every situation. It’s just about sitting down with the right mortgage professional to map it out for you.”

It can take time to improve your credit. Hinojosa explains credit is reported on a month-by-month basis, so it may take a few cycles or more to get your score where you want it to be. In cases where a home buyer needs to secure a mortgage quickly with their current credit score, Hinojosa says a mortgage professional can explore different options.

“In some cases if they have to purchase right away or they need to do a mortgage transaction right away—I like to call it stepping stones—they may have to look at an alternative type of lender which might come with a slightly higher interest rate,” said Hinojosa. “However, it’s still affordable with your cash flow and it’s just a stepping stone that will get you in a year or two over to a traditional bank.”

The article above is for information purposes and is not legal or financial advice or a substitute for legal counsel.